Post the entry using t-accounts to represent ledger accounts takes center stage in this comprehensive guide, providing a thorough understanding of the fundamental concepts and practical applications of this accounting technique. Delving into the intricacies of T-accounts, this guide empowers readers with the knowledge and skills necessary to navigate the complexities of accounting with precision and clarity.

T-accounts serve as the cornerstone of accounting, offering a visual representation of ledger accounts that simplifies the recording and tracking of financial transactions. By understanding the structure and components of T-accounts, readers gain a solid foundation for comprehending the intricate workings of accounting systems.

Introduction to T-Accounts

T-accounts are a fundamental tool in accounting, representing ledger accounts in a simple and visual format. They provide a structured way to track financial transactions and their impact on the account balances.

A T-account consists of two vertical lines, forming a “T” shape. The left side represents the debit side, while the right side represents the credit side. Each transaction is recorded on both sides of the T-account, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

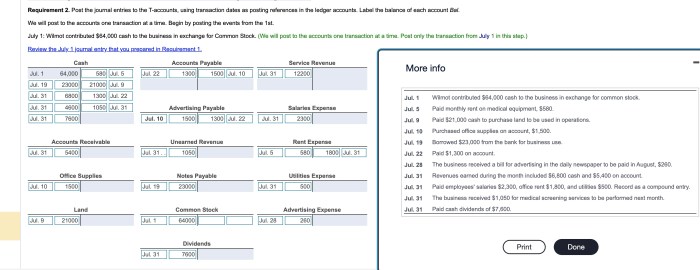

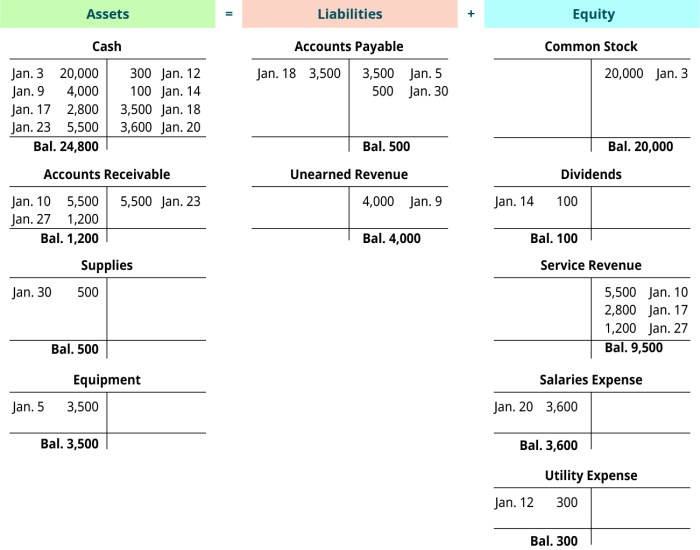

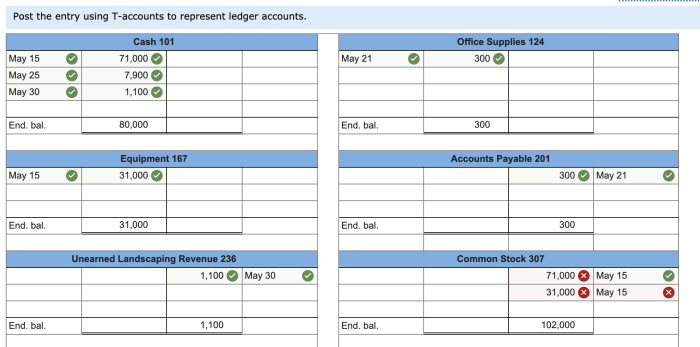

Posting Transactions to T-Accounts: Post The Entry Using T-accounts To Represent Ledger Accounts

Posting transactions to T-accounts involves recording the effects of each transaction on the appropriate accounts. Debits increase the balance on the debit side, while credits increase the balance on the credit side.

For example, if a company purchases inventory on account, the inventory account (an asset) is debited, and the accounts payable account (a liability) is credited.

Using T-Accounts for Ledger Accounts

T-accounts can represent various types of ledger accounts, including assets, liabilities, equity, revenue, and expenses. Each account has its own T-account, allowing for a comprehensive view of the financial transactions affecting the account.

For instance, an asset account, such as Cash, will show the inflow and outflow of cash, providing a running balance of the available cash.

Example of Posting an Entry Using T-Accounts

To illustrate the posting process, consider the following entry:

Cash 100 | Accounts Receivable 50 | Sales Revenue 150

The corresponding T-accounts would be:

| Cash | Accounts Receivable | Sales Revenue |

|---|---|---|

| 100 | 50 | 150 |

The debit to Cash increases its balance by 100, while the credit to Accounts Receivable increases its balance by 50. The credit to Sales Revenue increases its balance by 150.

Benefits of Using T-Accounts

T-accounts offer several benefits for accounting purposes:

- Simplicity: T-accounts are easy to understand and use, making them accessible to individuals with limited accounting knowledge.

- Visual Clarity: The visual representation of transactions in T-accounts provides a clear understanding of the flow of funds and the impact on account balances.

- Error Checking: T-accounts facilitate error detection by ensuring that the accounting equation remains balanced after each transaction is posted.

FAQ Explained

What is the purpose of using T-accounts?

T-accounts provide a visual representation of ledger accounts, making it easier to track and understand the flow of financial transactions.

How do I create a T-account?

A T-account consists of two sides: the left side (debit) and the right side (credit). The account name is written at the top, and transactions are recorded on the appropriate side.

What are the benefits of using T-accounts?

T-accounts offer several benefits, including simplicity, visual clarity, and error-checking capabilities, making them a valuable tool for accountants.